Chapters From my Book

Table of contents

Normal is a Loser

Even though your broker makes all the tools under the sun available to you, no one is immune to the statistics of the financial markets. Unless you have gone through some sort of structured training or you have been schooled by someone who is walking the path you yourself want to walk on, or you give this endeavour some serious thought, you will most likely fail in the financial markets.

Look at any broker website in the European Union, and you will see the failure rate. The brokers are obliged by law to post them on the front pages of their websites. Here are some of the biggest and most well-known CFD brokers in the world, and their failure rates:

| BROKER | FAILURE RATE |

| IG Markets | 75% |

| Markets.com | 89% |

| CMC Markets | 75% |

| Saxo Bank | 74% |

| FX PRO | 77% |

Rates correct as of 7 November 2019.

I know you like to think you are different. However, in the eyes of the financial markets, you are statistically like everyone else.

You can look at the top ten brokers of the world and the statistics do not change. You can look at CMC Markets, you can look at IG Markets, you can look at Gain Capital, or you can look at any one of the top tier or second tier CFD brokers. No one will have a failure rate less than 70%.

There is one exception to this. I found a broker that has a 59.6% failure rate. I suspect it is because of their tight fixed spreads. The spread does matter immensely to the profitability of your trading, especially as a day trader. The spread is the silent commission. Still, I don’t think that a 59.6% failure rate is too impressive either.

Normal is bad

What is the point that I am trying to get across to you?

I’m trying to make you see trading for the holistic enterprise that it really is. I am doing my best to make you understand that fundamental analysis or technical analysis or whatever tool you are using for your trading will simply not make you money over time, unless you add another ingredient to your trading. This ingredient is not easy to acquire, mostly because people are looking in the wrong place.

If you want to be a good a trader, if you want to achieve the level of success that you know is possible, you immediately need to stop thinking that the path to riches in trading has anything to do with the tools or techniques you are using.

Yes of course you need a strategy. Yes, you need a plan. Yes, you need to understand the markets. So, what is this book all about, if it is not about tools and strategies?

Well, let me address that question from a different perspective. Let me address it from the perspective of the people who work in the industry as brokers and sales traders and as marketing people. Do they trade? I would say most likely they do not. Yet, you are taking advice, guidance and training from them. You are being guided by people who are no better at it than you are.

It reminds me of Fred Schwed’s book, Where are the Customer’s Yachts?, where he says that Wall Street is the only place in the world where people who arrive to work by train and bus give advice to people who arrive by limousine and helicopter (slightly paraphrased for a more modern touch). You are being guided by people who can’t trade!

Guided by the blind

When you go to trading shows, read trading magazines, or look at the online education materials on broker websites, 100% of the focus is on what I call How To:

- How do I scalp?

- How do I swing trade?

- How do I day trade?

- How do I trend follow?

- How do I trade the FX market?

- How do I use Ichimoku charts?

- How do I trade with MACD or Stochastics?

This is perfectly normal. The trade shows and magazines are geared towards providing you with solutions most people believe they need to make money in the financial markets. The brokers are following the same path. They provide you with the information that they think you need and that you think you need.

As a newcomer to the industry of trading, you are most likely guided by the very people who are likely to set you off on the wrong path. You are led to believe that it is all about technique and strategy, and no one is preparing you for the fact that it isn’t a strategy that will set you apart from other traders.

It is how you think about your strategy and your ability to follow the strategy that will set you apart.

Do you not wonder if this is the right path for you? Do you not wonder about the futility of dedicating all your resources to one pursuit, when virtually everyone who walked that path before you has failed? It should. You really should ask yourself what makes you different to the 90% of traders that do not make money. If you are normal, as in you do what everyone else is doing, then you won’t make it.

NORMAL WILL NOT CUT IT

I was invited by the organisers of one of these trade shows to give a talk. This one was in London, and I was told I could talk about whatever I wanted. I decided to give a talk about the disastrous failure rate in the trading industry.

My argument is that if 90% of all CFD accounts lose money, the problem is a human problem. I feel I am making a reasonable assumption when I say that everyone opening a CFD account is a normal person with a normal way of thinking. Therefore, I conclude that there must be something inherent in the way normal people think and act that makes trading so unsuccessful for them.

Why is there such a high failure rate in trading?

This is a human problem. It is not a broker problem. It is not a market problem.

It should be easier than ever.

When I started in this business 20 years ago, the spread in the DAX was 6 points intra-day and the spread in the Dow index was 8 points intra-day. Today, these indices have doubled or tripled from their price levels of 20 years ago (Dow was around 10k, and DAX was around 6–7k), yet the spread has come down to just 1 point with some of the brokers I trade with. I mentioned above how small spreads are compared to twenty years ago.

Therefore, it should be easier than ever for traders to make money. However, it isn’t. People are still struggling to make money trading. My main premise for this book is to get to the bottom of this conundrum. The approach I have taken is centred around the following facts:

- It has never been easier to trade. The IT infrastructure is superb for traders.

- The spreads have never been lower.

- The margins have never been more favourable.

- The tools have never been so readily available.

- The brokers have never done so much for their clients as they do now.

- The stock indices have never been higher, meaning there is volatility.

Additionally, I assume that people who open trading accounts are normal, well-adjusted human beings, who are perfectly capable of functioning within society. I assume they are normal, without using the word normal as a slight or an insult.

The question I want to ask, and answer, is this: What does normal behaviour look like? How can I avoid being normal when I trade? The assumption is that the 80–90% of people trading are normal people, and I want to avoid acting like they do.

Are you normal?

My argument, provocative as it is, in its simplicity, asks an essential question: Are you thinking like everyone else is thinking? Are you approaching trading like everyone else is approaching trading?

If so, you may have a problem.

If you think like everyone else, is it so strange that you get the results that everyone else is getting?

What normal people do

Let us take a look at what normal behaviour is.

Normal behaviour is to engage in a never-ending cycle of education – looking for the next new edge. I knew from the moment I read Liar’s Poker that I wanted to be a trader, but I never had any formal training on how a good trader behaves. Why should I? I was always told that a good trader buys low and sells high.

Except for every time I bought low, it always went lower and lower. What kind of advice is that?

And yet this is what we listen to when we start. This is the benchmark, and if this is the benchmark, then it is a miracle that it is only 90% that are losing. It should be 100% because buying low and selling high is a sure recipe for ruin.

People will learn to use tools such as candlestick analysis. People will attend weekend courses hoping to learn secrets. People will study the use of tools such as stochastics, RSI, MACD, moving averages, and the list goes on and on and on. This is normal behaviour in a nutshell.

Even the bible

Even the bible of technical analysis doesn’t do much to help a person on their way – once the initial learning curve is over. Over the years, many a Wall Street acolyte has made pilgrimages to the Trinity Church Bookstore to buy the bible. Not the King James version, mind you, but the bible for technical analysis authored by Edwards and Magee, Technical Analysis of Stock Trends, which has sold more than 800,000 copies since its first printing in 1948.

What most readers don’t realise, however, is that Edwards and Magee were not the real creators of modern technical analysis. It was a little-known technical analyst named Richard W. Schabacker.

A brilliant market technician, Schabacker codified almost everything there was to know about technical analysis up to his time – which included such pioneering work as the Dow Theory of Charles Dow. Between 1930 and 1937, Schabacker taught several courses to serious Wall Street traders and investors. Unfortunately, he died in 1938 when he was less than 40 years old.

Shortly before his death, Schabacker gave a mimeographed copy of his lessons to his brother-in-law, Robert D. Edwards, who rewrote Schabacker’s lessons with the help of his collaborator, John F. Magee, an MIT-trained engineer. As a result, it was not Schabacker who received credit for the original compilation of technical analysis, but Edwards and Magee, whose work became a perennial bestseller.

Let me be clear. Reading a book like Technical Analysis of Stock Trends is a must, but please don’t think that it will make you a professional, profitable trader, anymore than reading a manual on tennis will enable you to compete with Rafa Nadal.

I’ll give you an example. Yesterday, 1 October 2019, was a particularly bearish day in the Dow index and the DAX index. I was short all day and I had one of my better days, all verified and documented on my Telegram channel.

Towards the end of the day, when the Dow index was falling even lower, a student of mine contacted me and asked me a very alarming question.

“Tom, do you think it is a good idea to buy now, ahead of the close?”

I reply: “hmm, I am short… maybe you should ask someone else.”

He replies: “well, the Dow has fallen so much today. Maybe it will bounce towards the close.”

No professional trader would in their right mind engage with the market ten minutes before the close. Why are you buying the Dow ten minutes before the close on a day where Dow has fallen 400 points? You have had all day to find a short entry. What are you hoping to achieve, by being a buyer now? Are you thinking that because it has fallen 400 points that now it is cheap, and maybe just before the close, you may see some buying of these cheap stocks? I used to think like that too. That was when I was not profitable.

The Dow didn’t rally into the close. There was no bounce. I am sure my student didn’t lose a lot. It wasn’t so much his wallet I was concerned about. It was his way of thinking. That is what this book is about. It is about making you think the right way about the market. That is where the 80–90% of losing traders tend to go wrong.

The 90% vs the 10%

We are all pretty much normal people. We need to be to fit in and function well within the fabric of modern society. If every person engaged in trading is a normal human being, meaning they are well-functioning, intelligent, considerate, hard-working, then why is there a 90% failure rate in our industry? That doesn’t make any sense at all. Usually when people work hard at something they will succeed, or they will see some degree of success. That doesn’t appear to be the case with trading.

Other professions do not have a 90% failure rate!

As traders, we tend to engage in a never-ending, predictable cycle. We do well for a while. We are happy and our discipline weakens. We lose money. We strengthen our resolve, and we get more education. We do well for a while. We lose money, we engage in more education.

Sounds familiar?

Am I against education? No, I am against people thinking that all it takes is more education. Sure, it takes education, but it must be the right kind of education.

It is true that I myself run one- and two-day courses, so I could easily stand trial for being a hypocrite. In my courses I tell people that for every hour you spend on technical analysis, you must set aside at least 25% of that time to what I call internal analysis.

You need to know what your weaknesses are. You need to know what your strengths are. You need to know what you are good at and you need to know what you are not good at. If you don’t spend time trying to improve that, how will you get better? Very few people, if any, will engage in that level of introspection in order to gain the results they want.

43 million trades analysed

There is a piece of research that makes for very interesting reading. It was the brainchild of an analyst called David Rodriguez, and it is brilliant. Rodriguez worked for a major FX broker, and he attempted to find out why there was such a high failure rate amongst its clients trading FX. The broker has some 25,000 people who trade currencies daily.

Rodriguez investigated all the trades executed over a 15-month period. The amount of trades was truly staggering. The 25,000 people executed close to 43 million trades. From a statistical point of view that creates a statistically significant and immensely interesting sample space to investigate. Specifically, Rodriguez and his colleagues looked at the amount of winning trades.

I would like to give you an opportunity now to think about how many trades were winning trades and how many trades were losing trades. You can represent it as a percentage of the overall 43 million trades.

If you feel it has any influence on the answer you want to give, I can tell you that most of the trades were executed in Euro Dollar, Sterling Dollar, Dollar Swiss and Dollar Yen. However, the vast majority of the trades were executed in Euro Dollar, where the spread is very tight. Unfortunately, that doesn’t seem to make much of a difference to the outcome.

62% of all the trades by the broker’s clients ended in a profit. That is a little more than six out of ten trades. That’s a good hit rate. A trader with the hit rate of six out of ten should be able to make money from trading. Of course, it does depend greatly on how much he wins when he wins and how much he loses when he loses. And in there lies the problem for the 25,000 people.

See, they were successful in terms of hit rate. Yet when you look at how much they made on average per trade and how much they lost on average per trade, you soon realise that they have a major problem. When they won, they made about 43 pips. When they lost, they lost about 83 pips.

There’s nothing wrong with having a system where you lose more on your losing trades than you win on your winning trades. However, it does require that you have a sufficiently high hit rate in order to absorb the losing trades.

A colleague of mine, a professional trader from South Africa who trades a hedge fund, has a hit rate of about 25%. I will tell his story in greater detail later in the book but let me explain the term hit rate in the context of his hedge fund. When his hedge fund lose on a trade, they lose 1X. When they win, they win as high as 25X. It stands to reason that my friend is immensely profitable even though he doesn’t have a convincing hit rate, at least not from a traditional perspective.

What I find particularly interesting is how much bad advice there is in the trading industry. You will often hear traders talk about risk-to-reward ratio, which in itself is fairly innocent, unless the trader takes it literally, and applies it on a trade-by-trade basis.

Trading with targets

When I call out trades in my live TraderTom Telegram group, I will always announce a stop loss. Always! However, I often get asked if I have a target in mind. The answer is quite often a little sarcastic: “No, my crystal ball is out for repairs,” or if I am particularly grumpy and tired, I will be rude and say “Sorry amigo, but do I look like a fortune teller to you?”

Yes, I know. It is not very polite. I am sorry. Ignoring my blatant inability to be polite when I am sleep deprived, there is a deeper meaning to me not calling targets on my trades. It has a lot to do with risk vs reward.

I personally find the whole risk-to-reward concept enormously flawed, but since I am the only one who ever talks about it, I accept that I am probably wrong. Still, hear me out.

How on earth do I know what my reward will be? I literally do not know. Even if I pretended to know, say by using a measured move calculation or a Fibonacci extension, etc., I know myself well enough to know that I will have added to my trade along the way, and when it got to my target, I would not close it, because that is my philosophy.

I would kick myself if I closed a trade at my target, and then it went even further. I would rather give away some of my open profits than miss out on potentially even more profits.

Now I am probably making a big fuss out of nothing, but targets are not for me. I want to see what the market will give me. I am prepared to accept that this may mean I will give away some of my open profits. I have lost count of the number of times I have had a 100-point winner in the Dow, which then turned into a zero.

Last week (all documented of course) I had one such winner, which turned into a big fat zero. I was confronted by some less than happy traders in my live trading room as to why I had not taken my profits. It is difficult to explain but it has all to do with pain.

It gives me much less pain to kiss goodbye a 100-point winner, than it does to take my 100 points, only to see the market moving in my favour. I find it very painful to take profits, only to see the market move even further in my favour. It is because of this philosophy that I am at times able to make 400-500 point gains, as I did today. It is one or the other. I don’t think you can have the best of both worlds!

Interview with CNN

In an interview with CNN some years ago, I was asked about the traits of winning traders. In this candid interview, I highlighted a few points that I felt differentiated the winning traders from the losing traders.

1. Trying to find the low

When the market is trending lower, whether it is intraday, or over a longer timeframe, there seems to be a tendency for retail traders to attempt to find the low of the move. Whether that is out of a desire to buy cheap and sell expensive, I simply don’t know. What I do know is that this trait is immensely damaging to anyone’s trading account.

2. Trying to find the high

The opposite also holds true. When the market is trending higher, traders tend to want to find a place to sell short. Although it must be said that people are generally better at jumping on board a market that has already risen than they are at jumping on board with a short position in a market that has already fallen significantly.

If the market has moved higher by a significant amount, especially in the very short term, retail traders tend to want to fade the rising prices, i.e. they look to establish short positions. Again, this is probably the result of a distorted view of things being cheap and things being expensive.

3. Thinking every small counter-move against a trend is the start of a new trend

Imagine the Dow is falling relentlessly during afternoon trading and you are sat on the trading desk observing people’s trading behaviour.

You wonder why people attempt to find the low of the day when all the Dow is doing is going lower and lower. Then it occurs to you that every single time people are buying, it is because the market is making the slightest little bit of movement to the upside.

The chart above illustrates this perfectly. It is a weak day, but there are small pockets of strength where the Dow rallies a little bit. They are usually short-lived, and the experienced trader uses it to get into short positions, while the inexperienced trader thinks that every single little counter reaction against the trend is the beginning of a new trend higher.

This is a common trait amongst traders. They think that every single little counter reaction against the trend is the beginning of a new trend. More fortunes have been lost trying to catch the lows in a falling market than in all the wars put together (unsubstantiated statement – made for emphasis – please don’t attempt to catch lows).

It seems obvious to me that newcomers and probably also some seasoned traders – profitable or unprofitable – believe that successful trading is all about charts. This belief is a detriment to their accounts, because no one ever took the time to tell them otherwise. No one told them, or thought to tell them, or knew enough to tell them, that actually focusing all your time on your charts is a mistaken strategy. We’ll look at this further in the next chapter.

Everyone is a Chart Expert

The job of a trader is to find low risk trading setups. That is the job description in a nutshell. Once you have found a low-risk setup, you must act. You must execute the setup. Once you have executed the setup, you have to manage the trade. That’s it. Job done.

I use charts to find setups. Charts can be as simple or as complicated as you want. There seems to be a tendency amongst traders to make charting more complicated than it really needs to be. I have seen new traders plaster their charts with so many tools that they can barely see the price chart itself.

90 years ago, a gentleman called W.D. Gann sold courses, which at the time cost the average American a year’s salary. It was esoteric – with its Square of 9 and Square of 144 and plenty of references to the bible – that people actually paid up to learn from him. They believed he had cracked the universal code for all stock price movements. They believed the man had found a secret code within the Bible – which when learned – could pave the way to untold riches.

Gann was no doubt a chart expert but the only code you ever need to crack is the code of your own emotions.

I am said to be an expert in charts, but I find that to be a terribly misguided description of me. A chart is only reflecting the current sentiment of the market participants. I don’t have a crystal ball. I am dealing with a game where players change their mind constantly, many times a day. I have no way of knowing what they are thinking.

Therefore, my job evolves around the theme of “what have they done in the past”. It is for this reason we sell double tops and buy double bottoms. We expect others to see the same and do the same.

It surprises many people, especially newcomers, when they see my chart screens. There is not a single indicator on them. Not one. I might be old fashioned, but I don’t need these extra tools.

I think the 90% of people that lose money trading may very well have excellent chart reading abilities. They can read charts very well, and they understand patterns too.

However, I happen to think there is much more to trading than knowing a “head and shoulder” formation, a bar chart pattern or a Fibonacci ratio. I have seen outstanding traders juggle millions of pounds worth in stock index futures contracts using nothing but a simple 10min chart. In fact, I do that myself every single trading day.

I honestly believe that what separates the 1% from the 99% is how they think when they are in a trade. That is not to say that there is no merit to learning the craft of chart reading. I know from my own experience that chart reading is an absolute must for my decision making.

From time to time, I will conduct a one-day or a two-day trading course, where I teach people things that I don’t think they would have noticed without considerable study time. I believe people attending the courses pay me for showing them what is important to me on a chart.

However, I am very quick to point out to my students that profitable trading is much more than just a chart pattern or two. It is for this reason that I run a live trading group every single day. I lead the way by showing people where I would like to be a buyer or where I would like to sell short.

Technical analysis is not difficult.

Learning the basics of technical analysis is not difficult. You can pick up a decent book on chart patterns on a Saturday morning trip to the shops, and by Sunday night you will know 90% of all the chart patterns I trade.

That makes technical analysis a compelling alternative to say fundamental analysis. What would rather? Spend a weekend on the sofa reading about patterns in the stock market, or spend 3 years studying a finance degree?

The “gurus” know this. You can attend weekend courses with cool sounding names like “The Millionaire Code Crash Course”. Who wouldn’t opt for that over say 3 years of grinding it out at night school or university? “By Sunday night you will be ready to conquer the markets.”

The fact of the matter is that you can acquire a relatively good foundation in technical analysis in a relatively short space of time, and you don’t need to pay a glamourized guru playboy thousands of pounds to teach you.

Buy some quality books and enjoy the fascinating world at your own leisurely pace. The markets will always be there. Just remember this. Reading some trading books or taking a professional accredited course like the STA diploma (Society of Technical Analysis), does not make you an accomplished trader any more than reading a book on golf makes you welcome on the professional golf circuit.

The reason I am saying that technical analysis is relatively easy to learn is based on observations. If people struggled to learn technical analysis, I don’t think we would see the win rates in for example the FXCM survey (mentioned in the previous chapter).

This survey of 25,000 traders executing 43 million FX trades over a 15-month period had a win rate of 62%. I believe a hit rate of that size is the reflection of good chart and trend reading abilities. A coin-flip strategy should produce a 50/50 outcome, but most retail traders have a hit rate around 65%. In my opinion this supports the argument that the real test of trading is how we think when we are in a trade.

I don’t think people need to learn more technical analysis to make more money. I think they need to learn how to play to their mental strengths.

I survived the flash crash of 2010, but only just. I was lucky not to be heavily embroiled in the Swiss Central Bank drama 5 – 6 years ago. Every day there are plenty of opportunities to bust your account if you are not mentally ready and fighting fit. And I can’t rule out the possibility of just being plain unlucky by having a big position on, just as Donald Trump makes a Twitter announcement that moves the market against your position.

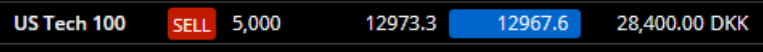

Let me get personal. I am short Nasdaq in 5,000 Danish Kroners per point on my TD365.com CFD account.

This is my third trade today. The first trade of the day, also a short in the Nasdaq, got stopped out. It was one of those “unfair” ones, where the market clips your stop by a point, and then it moves in your favour. It happens. Move on.

I shorted again, and I did what I always do when I am in a profit. I add to my winning position. Am I tempted to take my profit?

Yes?

Why is that?

Yesterday was an awful day. I lost. I read the market poorly. I had an idea, and the idea didn’t work out. Either way, I lost.

If I close my DAX position right now, I can make up for the lost trade this morning, and I can recover a lot of the points lost yesterday.

Is that the right way to think? Of course, it is not. Yesterday has nothing to do with today. Moments later I am rewarded for my patience. I have 5 times more profit now than a moment ago.

Am I tempted to close that trade? Yes. Why? Because if I close all the trades right now, I can make back what I lost yesterday. It would be as if yesterday’s losses and this morning’s losses never happened. Now that is a soothing thought, isn’t it?

You have this ping-pong dialogue in your head, arguing for and against taking profits. I am no stranger to that conversation. I may have many years of trading experience, but I still have those thoughts in my head.

What I am experiencing is known as Cognitive Dissonance. In the field of psychology, cognitive dissonance is the mental discomfort – psychological stress – experienced by a trader who holds two contradictory beliefs or ideas. This discomfort is triggered by a situation in which a person’s belief clashes with new evidence perceived by the person. When confronted with facts that contradict beliefs, ideals, and values, people will try to find a way to resolve the contradiction to reduce their discomfort.

The best way for your rational mind to resolve the discomfort of a profitable position is to close it. The best way for the rational mind to resolve the discomfort of a losing position is to let it run.

From the book “A Theory of Cognitive Dissonance” from 1957, the author Leon Festinger proposed that human beings strive for internal psychological consistency to function mentally in the real world. He says that a person who experiences internal inconsistency tends to become psychologically uncomfortable and is motivated to reduce the cognitive dissonance.

One way to achieve the goal of reducing the discomfort is by making changes to justify the stressful behaviour, either by adding new unsubstantiated or irrelevant information to the cognition, or by avoiding circumstances and contradictory information likely to increase the magnitude of the cognitive dissonance.

In my case, I am conflicted. I am associating pain with the performance of yesterday. I am able to eradicate the pain by closing my positions right now. The way I am able to justify this reasoning is by ignoring the information the market is giving me about my position. The market participants agree with me that the market should be sold short, but instead of acknowledging this, I am considering ignoring it.

From a logical point of view, this all makes sense. From an emotional point of view, this is an inconsistent approach to trading. My trades from yesterday have no bearing on the markets today. It is a new day. It is a new set of circumstances. Yet to my mind, the two trading days are connected. To my mind I am continuing today what I did yesterday. Why wouldn’t I be, I tell myself? If I am on a roll, I bring that enthusiasm and confidence with me to the next day.

Are you telling me that you can “reset” your emotions every morning? Are you telling me that you can go to bed at night after a blazing row with your loved ones, and you wake up all reset and emotionally in equilibrium? I doubt it. It is for this reason that I warm up ahead of the trading day, by going through a process. We will cover that later.

However, there is a simple way to resolve this cognitive dissonance. When I say “simple”, I acknowledge that it is anything but simple, because we are dealing with emotions, and none of us are governed purely by logic. Where is Mr Spock from Star Trek when you need him? He battled to reconcile the two natures within him—the rational, serious-minded pragmatism of the Vulcan and the wild, un-tempered emotionality of Earth. This half-Vulcan half-human spent his entire life trying to accommodate these halves, for the purpose of creating a balanced centered being.

Fear

The cause of the conflict is down to fear. Let us call a spade a spade: we are afraid of losing money. We are afraid we have taken on too much risk. We want the upside without the downside. We want the big stake but without the risk. We want to win big and lose nothing.

It is our fear that stops us from conquering our wildest dreams. You know the clichés, as well as I do. Face your fears, live your dreams etc. I even have a notebook, which has on its front page my favourite fear quote.

“Everything you ever wanted lives on the other side of fear.”

Yet fear is a necessity in our lives. The human brain is a product of millions of years of evolution, and we are hard wired with instincts that helped our ancestors to survive. We need fear to ensure survival in certain situations, but many of the fears that we are hard-wired with are not appropriate for our trading.

Our minds have a primary function, which is to protect us against pain. If you introduce big drastic changes in your life, you are likely going to come face to face with that pain. A clever way to introduce staying power for your change is to introduce change slowly.

Say you set yourself the ambitious target of running a marathon, you achieve this goal by building up your body and mind for the task. Trading big size is exactly the same process. You need to give your mind time to learn to handle the mental anguish that comes from losing when the stakes are bigger.

There is no point in comparing yourself with others. Sure, take inspiration from others, but know this is a personal journey, and your job is to achieve an equilibrium mindset, no matter what size you are trading.

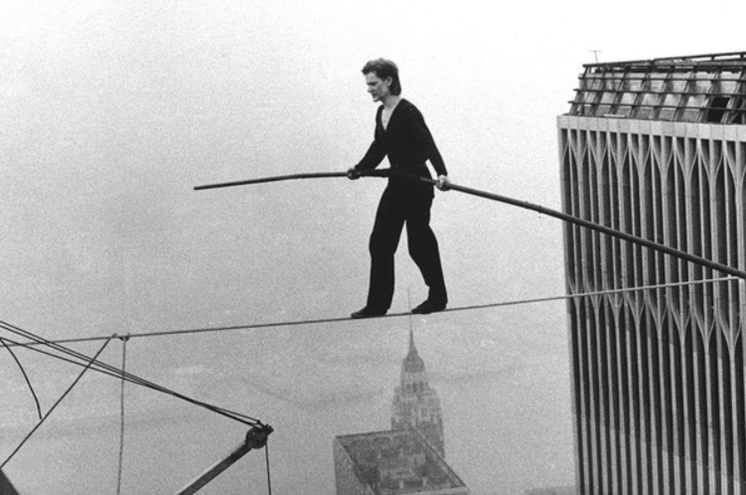

You want an example? You want some inspiration? Then why don’t you cast your eyes on the photo below. This is a photo of a gentleman called Phillipe Petit, as he is making his way from one of the towers at the World Trade Centre to the other tower.

I saw the original documentary a long time ago. This was long before the Hollywood adaption of the story. What struck me about the incredible feat was the preparation.

It took Phillipe some 7 years of preparation to accomplish the feat. Did you think he just set off and hoped for the best? Hell no. He prepared and prepared. I took a snapshot from the Netflix documentary, which has old grainy black and white videos of his preparation.

As you can see from the image, his original training height was quite modest, compared to what he would eventually end up with.

Phillipe Petit is a fascinating character, and he is someone who has had to deal with fear at a whole other level than any of us ever had to. I have learned a lot about fear and identifying my own shortcomings by studying his approach to his craft.

He Wants to Visualise Victory

Petit said,

“Before my high-wire walk across the Seine to the second story of the Eiffel Tower, the seven-hundred-yard-long inclined cable looked so steep, the shadow of fear so real, I worried. Had there been an error in rigging calculations?”

How did he overcome his doubts? With a simple visualization exercise:

“On the spot I vanquished my anxiety by imagining the best outcome: my victorious last step above a cheering crowd of 250,000.”

He Exaggerates His Fears

Rather than try to muscle through or outwit fear, Petit suggests taming it by building it up so that when you are finally faced with your fear, you will be disappointed by how mundane the threat really is.

“A clever tool in the arsenal to destroy fear: if a nightmare taps you on the shoulder, do not turn around immediately expecting to be scared. Pause and expect more, exaggerate. Be ready to be very afraid, to scream in terror. The more delirious your expectation, the safer you will be when you see that reality is much less horrifying than what you had envisioned. Now turn around. See? It was not that bad–and you’re already smiling.”

He goes on to say that he has fears like everyone else. In particular, he talks about his dislike of spiders.

On the ground I profess to know no fear, but I lie. I will confess, with self-mockery, to arachnophobia and cynophobia (fear of animals). Because I see fear as an absence of knowledge, it would be simple for me to conquer such silly terrors.

“I am too busy these days,” I’ll say, “but when I decide it’s time to get rid of my aversion to animals with too many legs (or not enough legs—snakes are not my friends, either), I know exactly how to proceed.”

I will read science reports, watch documentaries, visit the zoo. I will interview spider-wranglers (is there such a profession?) to discover how these creatures evolved, how they hunt, mate, sleep, and, most importantly, what frightens the hairy, scary beast. Then, like James Bond, I won’t have any problem having a tarantula dance a tarantella on my forearm.

Petit’s walk remains one of the most fabled, and stunning, acts of public art ever. He says there was no WHY to why he did it. To quote his own words, here he is:

To me, it is really simple. Life should be lived on the edge of life. You have to exercise rebellion, to refuse to tape yourself to rules, to refuse your own success, to refuse to repeat yourself, to see every day, every year, every idea as a true challenge, and then you are going to live your life on a tightrope.

No fan of clichés

I am not a fan of clichés. They display a lack of original thought. I am quite cynical towards those who peddle clichés. It doesn’t sit well with me to hear people say that I should run my profits, but I should cut my losses. It doesn’t sit well with me when a female friend tells me she is in an abusive relationship, and another friend chirps in and dismissively states that the solution is to “just leave the bastard.” It is a platitude. It is factually true, but it is nonsense, nevertheless. When a solution is obvious, the problem is rarely the only problem. You might as well tell an alcoholic to just stop drinking. There is a reason he is drinking, and there is a reason he is struggling to stop.

Failure is always a possibility in life. I participate in a radio program about trading and investments. The focal point of the show is the competition between me and two other traders. The competition is always fierce, and every week we are being questioned about the content of our portfolios. My trading style is quite black and white. If I think the market is headed lower, I will buy some put options or some bear certificates, and vice versa if I am bullish.

I learned a long time ago that the best way to shut down a journalist is to be 100% honest. So, when the radio host baits me by saying “uhm Tom, you got that one wrong, huh?”, the worst thing I can do is to start defending myself. If I start making excuses or put up defences, I simply pour petrol on that fire.

It is such a great metaphor for life. Own up to your errors and be done with it. So when the radio host is trying to engage in a line of questioning aimed at getting me to defend myself, I always double down in the opposite direction by saying something like “Oh my lord, I don’t think I could have been more wrong, even if I tried”, or “Oh boy, even a 5-year old could have done better than me.”

Elon Musk

We are bound to make mistakes in life, but mistakes are like fuel for the rocket of improvement. Talking of rockets, how do you think people like Elon Musk handle failure? He is trying to accomplish humongous life changing things — things like the electrification of automobiles and the colonisation of space, and he does it while the whole world is watching.

For him the possibility of failure is ever present, but when he fails, it is a spectacular headline creating spectacle, and yet Musk just keeps on going and going, doing incredibly audacious, risky, and valuable things.

How does he handle his fear of failure? Or is he just some superhuman, genetically gifted individual with a mercifully malfunctioning anxiety circuitry? Nope. Apparently not. He has publicly stated he feels fear quite strongly. So how does he keep going despite this terror?

Passion

Musk, it seems, has a two-part recipe for fearlessness. The first essential ingredient is heaps and heaps of passion. The SpaceX was an insane venture, but he had a compelling reason for pushing ahead: “I had concluded that if something didn’t happen to improve rocket technology, we’d be stuck on earth forever. People sometimes think technology just automatically gets better every year but actually it doesn’t. It only gets better if smart people work like crazy to make it better. By itself, technology, if people don’t work at it, actually will decline. Look at, say, ancient Egypt, where they were able to build these incredible pyramids and then they basically forgot how to build pyramids…. There are many such examples in history… entropy is not on your side.” Elon Musk was not prepared to sit idly by and watch that outcome unfold.

Musk also deploys a strategy of fatalism. Just focusing on why you’re taking a scary risk isn’t always enough to overcome hesitation. It wasn’t for Musk. He employed an additional strategy as well. You could call it strategic pessimism. He calls it “fatalism.”

“Something that can be helpful is fatalism, to some degree,” Musk has said. “If you just accept the probabilities, then that diminishes fear. When starting SpaceX, I thought the odds of success were less than 10 percent and I just accepted that actually probably I would just lose everything. But that maybe we would make some progress.”

He is not the only one to use this strategy. By really visualizing the worst-case scenario can make you appreciate objectively what you are trying to achieve. It’s a form of exposure therapy: by facing the thing you fear, you break its power over you and realise that you will survive even if the worst comes to pass.

Have I digressed too far from the trading journey ahead? I don’t think so. I draw inspiration from many sources outside of the trading world. Kobe Bryant, Rafa Nadal, Charlie Munger, to name a few. Very different people, yet all obsessed with the journey and the enrichment of their lives and the perfection of their craft. Studying their approach to their work suggest they found the thing they would love to do, even if they didn’t get paid for it. I am sure they are businessmen too, and I am sure they keep an eye on the dollars coming in. However, it feels like they perform their craft for the love of it.

A journey like no other

How bad do you want it? Is this journey for you? I don’t know. Only you can answer that. Permit me to ask you a question: what is the alternative? You are reading these pages because you want to trade well. Perhaps you have been in my live trading room and you have seen what my trading philosophy is doing for me. You want to learn more. I applaud that.

Perhaps it is time to acknowledge trading for what it is? It is a great way to expose all your flaws. It is a great way to highlight your strengths. Through my trading and my research, I have uncovered weaknesses in my character. To me the side benefit of earning a living from trading the financial markets is the character traits it instils in me. I am more patient than ever. I am much more focused and disciplined than I ever was. Failure is one of our greatest learning tools.

Well, that was a heavy section. I hope you are still with me. You know, one of the hard parts of change is how other people perceive our quest. Not everyone is as supportive as one could wish for. To silent our inner critic is hard enough, but when we also have to silence our friends and colleagues, it becomes much harder.

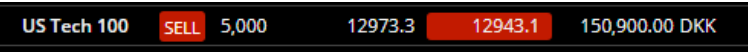

And the trade I had running here:

That’s the discipline of this vocation – you can’t just take profit because you feel like it. There must be a reason to why you are doing what you are doing. Otherwise, the market will run around corners with you and your emotions.

Do you really want it?

Do you really want to trade profitably? I have had to answer that a few times in my career. I have had to make some sacrifices along the way. I have been called out once by a coach, who felt my effort was insincere.

I found myself having dinner with a friend recently. I have known him for 15 years. I met him when I did a speech somewhere in the north of England. My friend had asked if he could consult with me while I was in Manchester to give a talk about trading, and naturally I agreed.

As we ate, he became very animated. At one point he knocked over a glass of water, whilst expressing his frustration with his trading. It was difficult to really pinpoint what the problem was in his trading, because he never made any specific reference to a problem.

It was clear to me that he really wanted help, and it was clear to me he was in distress, but I was unable to figure out in what capacity my help should come in. So, I offered him help in the one area that I felt was appropriate. I offered to go over his trading statements. As I see it, that is the only way I can really help someone. It is a lot of work, but at least I am getting a sense of who he is, as a trader.

As we said our goodbyes, he told me he would send over his statements. I nodded, and I said I would look forward to hearing from him. As I write this, he has not emailed me. Silence. Not a word.

If I am offered help in an area where I desperately want to excel, and the help comes from a friend who is an expert in the area, I will respond as soon as I can, if not immediately. As of now, some 4-5 days later, I haven’t heard a peep.

How badly do you think he wants this? How desperate do you think he is? I question how much he really wants this. I have observed this pattern on many occasions. The student claim to be really keen, but in reality, it is merely words.

It reminds me of a conversation that the famous trader Ed Seykota had with another brilliant trader. The friend told Ed that he intended to coach a losing trader into a winning trader by teaching him some important pointers that was missing from his trading.

Ed Seykota paused for a second, and then said that he would fail to teach the student anything. He said that a losing trader is not going to wish to transform himself. That is the sort of thing that only winning traders do.

We can all ask for guidance from someone who is better than us. As the saying goes, you only get better by playing a better opponent. I have guided many that were already well on their way to trading with confidence. I merely refined and suggested.

Whether I will hear from my friend remains to be seen. What is known is that many open trading accounts in the hope of making money. Their effort is disproportional to their expectations, and their results are aligned with their effort. They simply don’t work hard enough.

Before I move on to the next topic, I want to warn you. I am a trader who uses charts, but that doesn’t mean that I believe charts are responsible for my profitable trading. I once read that technical analysts are afraid of heights. That is another way of saying that they are unable to let their winners run, because they keep seeing reasons for closing their trades.

I have called the next chapter The Curse of Patterns, because I believe fully that as much as patterns help us, they also make our lives difficult in trading. In search for patterns, we see things that are simply not there.

The Curse of Patterns

Chart reading is an acquired taste. To some charts make sense. To others they are akin to voodoo or studying tea leaves. Chart analysis is not a particularly respected field in mainstream financial news. The majority of guest on finance shows such as CNBC and Bloomberg talk about the fundamentals of a stock or the economy or a sector.

Charts are nothing more than a collective representation of the current sentiment. As such they have one advantage over fundamental analysis. They tell it as it is.

They don’t add. They don’t subtract. They just show what is going on right now, and what has been going on in the past.

At university I was schooled on the fundamentals. When I left higher education, I devoted my time to learn about charts. Am I opposed to fundamental macro analysis? No. I would be a fool if I dismissed the fundamentals. I need to understand what other people are thinking.

Believe it or not, the two should not be in opposing camps. They should walk hand in hand, as they complement each other and make up for each other’s flaws.

Now, I would not go so far as to say that chart analysis is the Holy Grail. Yes, I have made a lot of money from becoming an expert in technical analysis, but I am also aware of the shortcomings in technical analysis. I don’t believe that there is a Holy Grail when it comes to trading, and I certainly don’t believe that chart analysis is the Holy Grail. I don’t believe W.D. Gann had found anything – other than a way of making other people believe he had found something.

Patternicity

In Latin there is a word apophenia. Translating it into common English, it would be “patternicity”. This behaviour is centred around seeing things that aren’t there. Our minds tend to seek out the information that confirms the bias that we have already decided upon. This is also called confirmation bias. Therefore, to be completely objective in chart analysis is virtually impossible.

My own mentor Bryce Gilmore once commented on this fact. He said to me: “Tom, you only see in the markets and on charts what you have trained your eyes to see.”

I guess another perspective of such wisdom is expressed by Anais Nin. She said,

“We don’t see things as they are, we see them as we are.”

What is the relevance to trading, I hear you say? I had a friend a long time ago who had made a lot of money trading. Nick was a great trader, right up until 2004.

He started reading and believing some writers and contributors on Zero Hedge and he turned bearish on the stock market. He kept shorting. But the market kept going up. He just could not accept that there was no more downside after the bear market of 2000-2003. He didn’t see the market as it was. He saw it as he was. He was negative. He had read that the bear market would continue. He stopped trading what he saw, and he let his opinion cloud his objectivity. He now works as a teacher.

I didn’t want to write a book or a presentation on charts. There are so many books on technical analysis, written by people who I wonder doubt trade full time. I think they tell themselves that because they have a trading account and because they trade from time to time, they are qualified to write books on trading.

Although I trade full time, I really don’t think I could add anything new to the world of charting. Charting didn’t make me money. Indicators never made me money. Ratios and bands never filled my bank account.

Nevertheless, I need to include some charts in order to get my philosophy across to you. I need charts to make some important points known to you. The following chart below is shown to illustrate the issue of patternicity in the context of chart analysis.

One of the easiest tools in chart analysis is trend lines. They are easy-to-use, and they give the appearance of a great trading strategy.

On this chart our trader has skilfully drawn a line from point 3 and connected some lower tops on the chart. As the market breaks through the downward sloping trendline, it generates a BUY SIGNAL.

If you are in a research position, and you draw enough of these trendlines after the fact, you’re most likely going to conclude that trendlines are nothing short of a fantastic tool, perhaps the Holy Grail.

Be careful.

Your eyes will tend to seek out that which you look to confirm. It is easy to see the profitable trend line breaks after the fact, but when you are sat in the thick of it, you are going to make mistakes. Like Mike Tyson says: Everyone has a plan until they get smacked in the face.

As we go to the next chart, you will now see a different perspective of the same chart.

The reseacher ignored this trend line break, because the eyes wont seek out that which disproves your presupposition. This is a trend line break, but it fails to deliver a profitable trade.

Figure 5.4

Divorce rates in Spain

The definition of ignorance is a lack of knowledge or information. You can be a smart individual but be ignorant in some areas.

For example, I am rather ignorant when it comes to love. I don’t believe in soul mates, which does make me a tad blunt and unromantic in the eyes of the other sex. You could argue that I am ignorant because I am not interested, or I don’t believe in it.

However, on the point of finding your soulmate, the one and only who you will spend eternity with, the lady or the man who is perfect for you in every shape or form, well I don’t believe they are real. You see, as ignorant as I am on the ways of love, I can read statistics, and I conclude that soulmates have better chances in certain countries.

For example, there are certainly not many soulmates in Spain or Luxembourg. Did you know that there is a 65% divorce rate in Spain and an 87% divorce rate in Luxembourg? There’s only a 42% divorce rate in the UK. Does that mean that you have a higher chance of finding your soulmate on the British Isles than in the warm climate of Spain?

Yes, I am just trying to be funny, while making an important point. I am trying to provoke a degree of confusion in you. You see, there may be people who believe the earth is flat. There may be people who believe in the mass cultural delusion that the sun’s heavenly position relative to randomly defined stellar constellations at the time of my birth somehow affects my personality – also known as horoscopes.

AND there are also people who believe that the markets are an equation to be solved, a code to be cracked. All of those people are delusional, or more politely put, they are ignorant.

Be careful.

The Fraud of the Candlestick Guru

In order to avoid a lawsuit, I have blanked out the name of the central character in the following story. When candlestick charts became a hot topic in the 1990’s, one person who had been instrumental for the propagation of its use, was sitting with myself and another trader in a New York restaurant.

The central character had at the time published books on the use of candlestick charts. As I sat in the restaurant in X, I asked him if he believed that some of these patterns had to be identified by different names, when for all intents and purposes, they were identical.

For example, I argued, the Harami pattern and the Harami Cross pattern are for all intents and purposes identical, except the Harami Cross pattern has no body, while the Harami pattern has a body. However, they are both inside bar patterns.

I argued that it felt as if there deliberately had been an effort to inflate the number of patterns, purely for commercial reasons, rather than for legitimate trading reasons. Many of the patterns are near identical but have different names.

I asked him if he had a favourite pattern he used, or a selection of preferred patterns he stuck to, and if so, what timeframe did he trade them on. He answered that he wasn’t trading the patterns. Not only that, he didn’t trade at all.

I don’t know how you feel about that, but that doesn’t sit very well with me. I immediately cut all ties with the gentleman. It felt as if his only mission were to invent as many patterns as he possibly could, in order to fill pages in books and courses, and create alerts on his trading software.

Am I arguing that candlestick charts are worthless? No. I just don’t believe that there is statistical relevance to all the patterns.

I am not alone.

I have found a handful of academic research articles, which suggest the same. Here is the conclusion from one such article, published in the Journal of International & Interdisciplinary Business Research in June 2018, called “A Statistical Analysis of the Predictive Power of Japanese Candlesticks” by Mohamed Jamaloodeen, Adrian Heinz and Lissa Pollacia:

Japanese Candlesticks is a technique for plotting past price action of a specific underlying such as a stock, index or commodity using open, high, low and close prices. These candlesticks create patterns believed to forecast future price movement. Although the candles’ popularity has increased rapidly over the last decade, there is still little statistical evidence about their effectiveness over a large number of occurrences. In this work, we analyze the predictive power of the Shooting Star and Hammer patterns using over six decades of historical data of the S&P 500 index. In our studies, we found out that historically these patterns have offered little forecasting reliability when using closing prices.

In another work by Piyapas Tharavanij, Vasan Siraprapasiri and Kittichai Rajchamaha, these researchers conclude the following:

This article investigates the profitability of candlestick patterns. The holding periods are 1, 3, 5, and 10 days. This study tests the predictive power of bullish and bearish candlestick reversal patterns both without technical filtering and with technical filtering (Stochastics [%D], Relative Strength Index [RSI], Money Flow Index [MFI]) by applying the skewness adjusted t-test and the binomial test.

The statistical analysis finds little use of both bullish and bearish candlestick reversal patterns since the mean returns of most patterns are not statistically different from zero.

Even the ones with statistically significant returns do have high risks in terms of standard deviations. The binomial test results also indicate that candlestick patterns cannot reliably predict market directions. In addition, this article finds that filtering by %D, RSI, or MFI generally does not increase profitability nor prediction accuracy of candlestick patterns.

It always looks easy afterwards

Brokers and educators have put the cart before the horse. They make us think that learning as many patterns as we possibly can, will increase our chances of trading success. This is simply not true. The more patterns we know, the more we are inclined to talk ourselves out of good positions.

There is nothing wrong with technical analysis and patterns, and candle formation and indicators and ratios and bands. Yes, I don’t believe in many of them, because they are subjective and don’t hold up under real scrutiny. But then again, trading is so subjective anyway that we don’t need to be right very much to make a good living from trading.

How professional traders trade and think

My friend Trevor Neil ran a hedge fund that had a 25% hit rate on their trades.

The reason why I want to tell you this story is because, as of right now, there is a very good chance that you have little or no idea about how professional traders trade and think. I hope the story will be illuminating, and I hope the story will give you a good perspective into how a professional trader thinks. It should also serve as a reminder that there are many ways to make money in the market. Your job is not to follow someone, but to find a way that you like, that resonates with you and who you are and what you like to do.

The story starts with me asking Trevor a question. I knew that he had been associated with Tom DeMark and his Sequential indicator. Tom DeMark is somewhat of a legend within the technical analysis world. I happen to have met him myself at a Bloomberg lunch many years ago. He seemed like a nice guy, although I had very little to ask him, as I was unfamiliar with his work. You see, his work was only available to those who had a Bloomberg terminal. The Bloomberg terminal at that time was $25,000 a year. Today though Tom DeMark’s work is available on many trading platforms, in case you are interested.

As I asked Trevor about the sequential indicator, his eyes lit up. He told me a story about how him and his friend had decided that there was an edge to be gained from trading the sequential indicator on a very short-term timeframe.

They moved to South Africa and started trading South African shares on a one-minute chart. I have never heard of a professional outfit, with significant funds under management, trade on such a short timeframe. However, that is not what impressed me most about the story. What impressed me the most was how they managed to make money on what other traders would consider an abysmal hit rate.

Most people believe that you have to deploy a trading strategy that has a hit rate which is at least better than 50%. Trevor told me that their results varied. There were times when they were hot, and there were times when they were not. When they were hot, the hit rate would push the 40%. When they were not, the hit rate was down in the mid-20s.

Overall though, Trevor told me, they had in their hands a tool that generated about 25-30 winning trades out of every hundred trades placed. They were wildly successful. They traded the fund for a handful of years, and then they returned the capital to the investors. They had made their money, and as neither of them were spring chickens, they decided enough was enough. It was time to go home and spend quality time with their families. Had they been younger, they probably would have continued.

Now I don’t know about you, but I like the story. It reaffirms the idea that I have about trading. It is much more important how you think when you trade, than whether your trading strategy has a hit rate in the 50s or in the 70s or in the 90s. While the story is not conclusive evidence that anyone can make money trading, as long as they have the proper money management rules and the required patience, it is a brilliant anecdote of two traders being able to make money, even though their strategy on paper from a conventional point of view should not have generated a profit.

So, what was the secret?

Well the answer is simple. Although they lost 75 trades out of 100 trades, those 25 trades more than surpassed in profits what the 75 trades generated in losses. Trevor told me that they expected to make 25 times in profit what the risk was. He also told me that when they executed a trade, they expected it to work immediately. So, I grilled him a little bit on that point.

“What do you mean you expected it to work immediately?”, I said. He said that when they executed a trade, they expected the trade to begin to work immediately. If they had bought at say 50, they would not want it to go to 48. If it went to 48, they would stop themselves out.

It meant they had plenty of small losses. Their back-testing had shown that if the strategy was to be traded correctly, it meant that it would work immediately. If it didn’t work immediately, the strategy called for the position to be closed.

Believe and act

When you can act and perform without any form of fear of consequences and repercussions, you are trading from an ideal state. When you consider how many people lose money overall in trading, you logically have to conclude that achieving this state is not an easy undertaking. It would be foolish to think that this state of mind comes easily or even naturally. It doesn’t.

I once sat and traded for a few months with a guy from Germany. He possessed an almost superhuman ability to do nothing. His patience was unrivalled. I made it a sport to be as patient as he was, while we traded together. It was fun and, dare I say, somewhat painful. I missed many a good trade, but the ones I took easily out-weighed all the other trades.

You must be patient with yourself. You must be able to let your knowledge settle and mature within you. If you trade small size now, but you want to trade bigger size in the future, then that journey will most likely be anything but linear. It will be a journey of progress and setbacks. It will be a journey of progress and status quo. I can guarantee you that. You have to grow into the trader you dream of becoming.

You must be patient with your trade entries. You must be patient with yourself. If you can bring those two qualities to the table, then the rest will solve itself in time. You will grow your trade size at a pace where your mind will not be alarmed or be fearful.

The Nature of the Game

Let’s sum this up….

The game never changes, and it never will. Algorithms won’t change the game. Laws won’t change the game. Because this is an inner game, and you need to spend time – maybe not as much time as you do on charts – but a huge amount of time contemplating what human qualities you are bringing to the game of trading.

Moving in the right direction comes from knowledge of yourself and an understanding of the markets. The game never changes. The players change, of course. We all grow old and die, and we are replaced with new fresh blood. Sadly, people don’t change, unless they make an out-of-the-ordinary effort to change.

We have a reptile mind, which is not fond of change. “Hey, if it ain’t broke, why do you want to fix it?” Well, because it is broken. I am not making money how I know I can, so I want to change that. If that means I have to learn to live under a different paradigm, and have a different perspective on fear and hope, so let that be it.

Third Level Thinking

John Maynard Keynes, the father of modern economics, expressed the essence of speculation with an analogy of a beauty contest. Imagine a newspaper prints the images of 30 beautiful ladies. Your job was to rank these 30 ladies in terms of beauty.

However, as John Maynard Keynes says, this has nothing to do with whether you like blondes over brunettes, or you like tall ladies over small ladies. In fact, this has nothing to do with your own personal preference.

Mr Keynes said that his own personal preference was irrelevant. Rather he argued that his job was to consider what other people are considering. He basically stated that investing or trading is the art of figuring out what the other person is thinking.

A Story About Technical Analysis

There are two major camps of analysis. There is a fundamental analysis camp, and there is a technical analysis camp. Fundamental analysts tend to pour scorn on technical analysts, while technical analysts tend to be rather disrespectful to people who have spent time and effort to learn the fundamentals of economics and stocks and sectors.

It is true that technical analysis is significantly easier to master than fundamental analysis. I spent four years of my life learning about the fundamentals of the financial markets, and even after such rigorous training I could hardly claim I had mastered my vocation.

Conversely, you can pick up a book on technical analysis on a Saturday morning, and by Sunday night you will have a very good idea of what technical analysis is all about.

It is probably for this reason that most retail traders believe that the path to trading profits is through technical analysis. However, it is arguably down to personal preference which tool you use. Some have made fortunes using fundamental analysis and some have done the same using technical analysis. It is not often you get an opportunity to put the two sides against each other. However, we are in luck.

CNBC runs a daily segment where a fundamental analyst and a technical analyst goes head-to-head, and they offer their opinion on where a stock or index or commodity is headed. Professor Avramov and Professor Levy, from Hebrew University of Jerusalem and Professor Kaplanski from Bar-Llan University concluded that the average buy recommendation from well-known technicians outperforms the broad stock market by 8% over the subsequent nine months after appearing on CNBC, while the average stock recommended by leading fundamental analysts underperforms the market.

To give a little more detail, the team of professors measured the performance of each recommendation given on the show on CNBC, beginning with its closing price on the day the show first aired. They found that the stocks that the technical analysts identified as strong buys on average proceeded to outperform the overall stock market by 7.9% over the subsequent nine months, while the stocks they recommended as strong sells underperformed by 8.9%.

That is a spread of 16.8 percentage points, which makes it highly significant from a statistical point of view. As the professors put it in their study, it means that “technicians display rather impressive stock-picking skills.”

The team of professors found that the fundamental analysts didn’t do very well at all. Their strong buys on average underperformed the market over the nine months following recommendation — though not by enough to conclude at the 95% confidence level that these analysts were actually worse than random. Even worse, the stocks that these analysts rated as strong sells did not perform appreciably differently than those, they considered strong buys. That is ugly reading for the fundamental camp.

However, before you head over to Amazon to buy a load of technical analysis books, I recommend you read the next few lines too. You see, the technical analysts didn’t emerge completely unscathed from the study. The professors found that, when it comes to broader asset classes such as stock-market industries and sectors, bonds, and commodities, the forecasts of both technicians as well as analysts are no better than random.

The technical analysts in this survey have far superior returns than the fundamental analysts. I suppose you could argue that I am biased. I don’t deny that. However, there is another reason why I prefer charts over fundamental analysis. It is not the only reason, but it is an important reason.

My Experience with Students

It has taken me nearly 10 years to understand why “how you think” is much more important than “how you trade” or “the tools you use”. You may wonder why I didn’t discover this earlier. The answer is that no one spoke about it. There is a whole generation of traders who got into trading around year 2000, who until now has been led to believe that trading is all about strategy and entry techniques.

We literally didn’t know why we were losing. We had all the latest techniques and timing tools. We subscribed to Matrix and Delta and Intra-Day Turns, and newsletters and read about ratios and were disciplined to follow the trend and yet somehow, we still ended up losing more than we made.

I had the advantage of being able to observe so many people trade that it acted as a catalyst on how not to do it. I built a trading philosophy around avoiding trading like everyone else did. At some point in 2015 I began to give a seminar here and there on trading. It was solely in Denmark, and it was only to people who had already been trained by me in a series of free evening speeches.

Over the last 4 years I have trained 200 people. I noticed a pattern in the people I trained . The path is almost identical for all of them. They attended a series of free talks in Copenhagen and some web-seminars too. They then paid for a 1-day workshop, which included a weekly 90-minute web-seminar session on a topic I selected. It was usually held on a Saturday, and it was recorded, so the students could watch it over and over.

On top of that I started a WhatsApp group, where I posted my trading entries and exits, so the students could observe the strategies in real-world trading conditions. Later I migrated to Telegram because it was more secure.

Out of the 200 people, I have regular contact with some 50 of them. The other 150 have disappeared off the grid. I don’t know if they are trading anymore, but I suspect they might not be trading. Did they give up? Was it not as easy as they had imagined? I will never know, unless I contact them. I invite them to attend talks and web-seminars, but I suspect that life just got in the way of their trading, and when the results didn’t materialise as quickly as they had hoped for, they gave up.

The 50 people I have contact with is proof that it is possible to make the financial markets your playground on a full-time or part-time/hobby basis. They engage with the music of the markets on a regular basis. They have persisted, and although their results are varying according to their commitment and their account size, they are still here.

This group of 50 people have proven to me that it is not enough to simply engage in the markets from a “technique” point of view. You must understand your own role. Are you trading from an opportunistic point of view, or are you trading from a point of view of fear or anxiety?

The group of 50 have proven to me that you can have the best understanding of a technique, but if you don’t have a foolproof mental stability, one that will ensure you don’t get knocked sideways when the market throws you a curve-ball, then you will without a doubt end up like the 90% losing money.

I have met some very smart people along the way, people who prided themselves with having a high IQ and being Mensa members. They failed. They were unable to make a success of it. Why do you think that is? Could it be that their intelligence got in their way? Could it be that all their life they have grasped and understood matters quicker and easier than normal people, and now they were faced with a problem which required them to look inwards?

The market is not an equation to be solved. It is not a conundrum that can be mused over during a casual conversation with a friend. It takes a lot of introspection to understand why your best intentions is not enough. To succeed you must accept that how you normally handle pain and discomfort will not suffice.

This leads me perfectly into my final comment before I move on to the next chapter.

Why am I spending hours and hours every day researching and contemplating?

Surely by now, I have trading down to a T.

There is a really easy way to answer that. A way that will make you understand it instantly, in the form of an analogy: When you lose weight, and you have done so successfully, can you go back to eating the way you did before?

Of course, you can’t. You would fail and you would put on the lost weight again. Trading discipline is not a one-off course or a one-off newsletter, or a one-off book, or a one-off session with your local therapist. It is a life-long devotion to your profession.

If you do that, you will be rewarded with riches. If you don’t, you will “put on the kilos again”. Discipline is a muscle, and it needs to be nurtured constantly, like physical muscles. Otherwise, you will develop mental atrophy.