The 30 Minute Guide to

Spread Trading &

Single Currency Spread Trading

By Tom Hougaard

Welcome to the 30 Minute Guide to Spread Trading and & Single Currency Spread Trading.

The guide should take about 30 minutes to read. By then you will know all there is to know about Spread Trading and & Single Currency Spread Trading. You might not be a trading expert yet, but you will understand how to use the products for your trading. The rest comes with practice.

The major questions I want to address in this short guide are:

- What is a Spread Trade?

- What is a Single Currency Spread Trade?

- What is margin?

- What is shorting?

- What size should you trade?

- How do you place a Spread Trade?

The guide is designed to get you ready to spread trade and trade Single Currency spread trades from a practical point of view.

- You will understand how a Spread Trading platform works.

- You will understand how to place a trade.

- You will understand how to determine what size to trade.

- You will understand the use of limit orders and stop-losses.

- You will understand how to sell short as well as how to buy markets.

The guide is not going to teach you how to decide what to buy or what to sell short. If you want to learn that as well, then join my Telegram Channels and download my free book on technical analysis.

I would like to recommend that you start your trading journey by using a demo account with a broker you trust. You can then practice without risking your money.

You are welcome to contact me – in any language – if you have any questions.

My email is hello@tradertom.com.

So, let’s get started.

Tom Hougaard – TraderTom

RISK DISCLAIMER

Tom Hougaard/TraderTom asserts the moral rights to the material in this book. All rights reserved. The material must not be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, in part or in whole, without explicit written permission of Tom Hougaard.

The material is purely educational in nature. Tom Hougaard, his employees and partners and anyone associated with the distribution and teaching of the material within, do not give trading recommendations. Any trades shown in any seminar or web-seminar are for educational illustration purposes only.

Past performance is no guarantee of future performance and you may not get back the amount you invest. The value of investments, and the income from them, may go down as well as up and are not guaranteed.

Spread Trading and Single Currency Spread Trading are highly leveraged products and carry high risk to your capital. Due to the leverage offered, it is possible for you to incur losses in excess of your initial margin. These products are not suitable for all investors so please make sure that you understand the risks involved. Rates of exchange may cause the value of investments to go up or down.

Tom Hougaard/TraderTom’s seminars and programmes are educational products and, as such, are not regulated. The information conveyed by Tom Hougaard/ TraderTom/trainers of TraderTom is intended to provide you with basic instructions regarding your personal investing and financial plan.

Tom Hougaard/TraderTom does not guarantee any results or investment returns based on the information you receive. Past performance and any example or testimonial cited are no indication or guarantee of anticipated future results. Individual results will vary and cannot be guaranteed.

If you have any doubts about your financial suitability for trading, please seek professional advice from a financial planner.

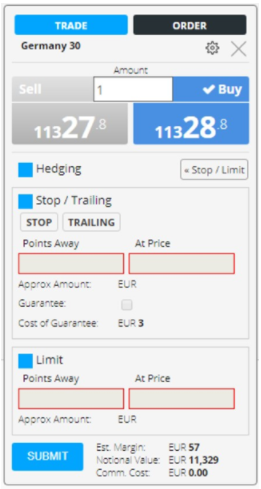

The Trading Ticket

I am going to start with the most essential part of any spread trading platform. When you execute a trade, you do it on a trading ticket. I am going to start the guide by explaining what the trading ticket looks like and what you need to know about it.

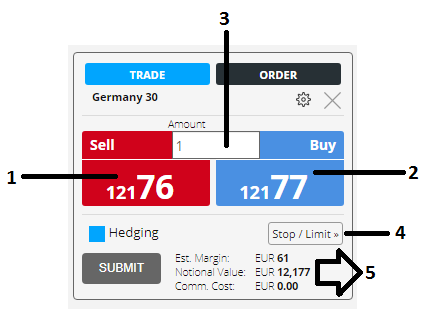

The trading ticket below is that of the German Dax 30 index. I have put some numbers on the trading ticket next to each area, which I want to explain.

Some of these expressions might be new to you. Do not worry. This is why you are reading my guide. I will teach you what margin is, what limit orders are, why there are two prices etc. So, do not worry about them right now.

Number 1: The price you can sell the DAX index at.

Number 2: The price you can buy the DAX index at.

Number 3: How much money you risk for every point the price goes up or down.

Number 4: This button will enable you to input a stop-loss order or a take profit order.

Number 5: Information about the margin requirement for this product.

Let us look closer at each point.

Number 1 and Number 2

The price of the DAX is 12,176 – 12,177. What does that mean, and why are there two prices? The answer is rather simple.

If you want to buy the DAX, then you can do so at the price of 12,177. If you want to sell the DAX, then you can do so at the price of 12,176.

Having two prices in the financial markets is very normal. It is called the Bid-Ask price. You may ask who gets the benefit of the point in the middle, between 76 and 77. The answer is the broker.

Number 3

This area is called the “Amount” area. It is in here you input how much money you want to risk per point movement in the Germany 30 index. In a moment I will illustrate how it works. First you have to learn to protect yourself. We do that by using a stop loss.

Number 4

The “Stop / Limit” button is used to place a stop loss order and or a Limit Order. Essentially the stop loss order protects you against severe losses. The Limit order is an order to exit with a profit.

Number 5

These numbers will tell you how much money you need in your account to execute a trade. In the “Amount” area, it currently says “1”. This means that you are placing a trade with a 1-euro risk per point.

The “Est Margin” says that this trade will need 61 euro in margin. I will talk much more about margin later in the guide. However, let me briefly explain margin in a sentence or two. Later you will get a much more in-depth explanation.

When you place a trade, you will need to place a small deposit of the value you are trading. The broker asks for a deposit against any losses that may occur. That is called “margin”. When I trade Spread Trading Contracts, I usually place a deposit on my account of about ½ % of the value I am trading.

In the chapter called Margin, I will go through this very thoroughly.

Illustration of Trade

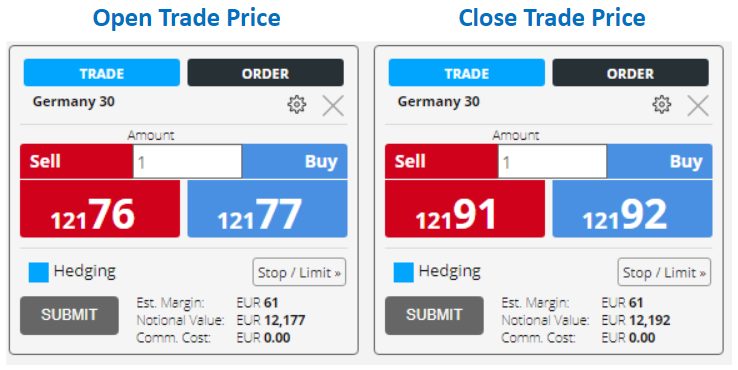

I think the best way to illustrate the goal of Spread Trading is by using an example of a trade I placed for myself. You will see two trading tickets below. One is labelled “Open Trade Price” and the other is labelled “Close Trade Price”.

Placing a Trade

I want to show you how simple it is to spread trade. In this example I am buying the DAX index at 12,177. I think the DAX will rise in value.

How much am I hoping to make?

In the “Amount” area, I have input the number 1. This means that I will bet 1 euro per point movement in the DAX index.

Let us go through this trade. Once you see a practical example, it becomes easy to understand how Spread Trading and Single Currency Spread Trading works.

Open Trade: 12,177

Close Trade: 12,191

Profit: 12,191 minus 12,177 = 14 points

Point Value: 1 Euro per point

Profit: 14 euros

When you start out trading, you probably want to start slowly. However, as your confidence grows, hopefully in step with the growth of your trading account, you will likely increase the size of your trades. Do not rush. Take it easy. Size will come soon enough.

Spread Trading and Single Currency Spread Trading is not just for beginners. Neither is it just for professionals. Both beginners and more experienced traders and professionals have the same prices and the same opportunities. We are all watching the same prices on the trading platform.

I am a full-time professional trader. There was a time when I traded 1 euro a point. Today I trade much larger positions. My trading size is somewhere between £250 and £1800, depending on what I trade.

It would be irresponsible of me if I did not show you the flip side of the coin of Spread Trading and & Single Currency Spread Trading. You will not win every time. I would like to illustrate that with an example.

Say you sold “short” the Germany 30 index below at 12,176, and you had to close the position at 12,192, you would lose money. Your loss exactly would be:

Entry Price Short: 12,176

Exit Price Short: 12,192

Points lost: 16 points

Value per point: 1 euro

Loss: 16 euros

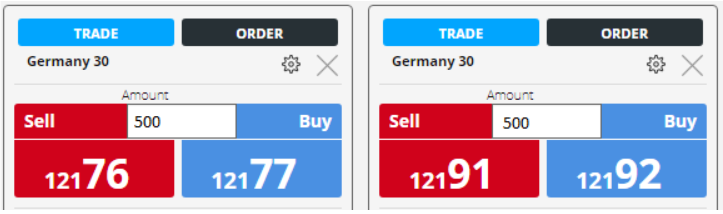

I will explain what selling short means in a separate chapter later in the guide. For now, I want to discuss what the value of a point is. You see, that is at the heart of the matter of spread trading. How much are you betting per point movement in whatever you are trading.

If “Germany 30” is trading at 12,177, and it then moves higher to 12,178, it has moved 1 point. If you had bought “Germany 30”, and you had risked 500 euros (input in the “Amount” screenshot above), you would have made 500 euros. I know this is a little extreme an example, but there are professional traders like myself that trades this size.

This is what you need to remember. You decide how much you want to risk per point. Whatever you want to risk per point is the amount that you input into the trading ticket.

If you are a seasoned professional trader, you probably want to trade with bigger amounts. If you are new and want to get started, you probably want to trade with very small amounts, such as €1 per point or less, or whatever currency you are trading in. We will discuss this point later when I introduce you to Single Currency Spread Trading.

Basically, you decide how much you want to risk per point. It is such an incredibly easy way to trade. All you have to remember is that your account size determines how big you can trade. If you have a relatively modest amount of money on the account, you will not be able to trade very big.

The ”Est Margin” determines how much you can risk per point. I will explain this completely in the chapter called “Margin”.

History of Spread Trading

Some people call it “Contract” trading. Others call it “Spread” trading. The main point is that you are given two prices, and the difference between the two prices is known as the “spread”. The reality is that Spread Trading or Contract Trading is the same experience whatever we call it.

Over the last two decades Spread Trading has become the preferred tool for the private trader in most countries across the world. Originally invented in the 90’s in London for institutional purposes, it quickly altered into the simple-to-use product we know today.

A technical definition of a Spread Trade goes like this:

“A Spread Trade is an agreement between two parties (the broker and the client) to exchange at the close of a trade, the difference between the opening price and the closing price of the underlying instrument, multiplied by the stake size of the trade.”

The essence of a Spread Trade is that it is an agreement between the broker and the client. The broker pays you or you pay the broker, depending on the outcome of the trade. The only thing that changes hands is money.

Either you are right, and the broker pays you, or you are wrong, and you pay the broker. What is important to know is that you are not trading the real product when you are Spread Trading. You are trading a derivative of the product.

This means that you don’t take ownership of the product. This may or may not concern you, but it is actually a very good thing for people who trade.

Let me give you a quick example.

I want to trade Crude Oil. Now I can go out and buy the physical Crude Oil from a chemical plant somewhere in Canada or Nigeria, and then find a place to store it, and then one day sell it to someone who wants to buy it off me.

That is an impossible mission for a private trader like me. Instead I buy a Crude Oil Spread Trade through a broker. Now I do not have to buy the real Crude Oil. I do not have to worry about storing it. I know I can always sell it back to the broker, whenever I want.

Whatever I trade using a Spread Trade product, I do not own what I am trading. I am purely speculating on the direction of the market. If I am right, I will be paid well for it. If I am wrong, then I will lose money. It is that simple!!!

As I see it, there are 7 key points to Spread Trading.

7 Key Points to Spread Trading

A Spread Trade is essentially just an agreement between you and the broker.

The Spread Trade instruments you trade follow the actual market 100%.

Spread Trades are traded on margin.

You can “go short” a Spread Trade.

You generally do not pay commission when you Spread Trade.

You can pretty much trade anything using Spread Trade products.

You do not own what you trade.

Now I will go through those 7 points in much greater detail, so you have a thorough understanding of Spread Trading and & Single Currency Spread Trading.

A Spread Trade is essentially just a contract between you and the broker

A Spread Trade contract is actually an artificial product, which is essentially just a contract between you and the broker. A Spread Trade is a derivate and an OTC (over the counter) product. It is solely an agreement between the broker and the client and is not traded on an exchange. Therefore, the underlying asset is never actually owned or traded.

This means you are only speculating on the direction of the market. You do not own what you are trading. If you trade Crude Oil, it does not mean that you own barrels of crude oil. If you trade tomatoes on a Spread Trade contract, you do not actually own the tomatoes.

A Spread Trade product follows the actual market 100%

A Spread Trade contract follows the actual market 100%. So, the DAX contract follows the German DAX index 100%. A Facebook or IBM share contract will follow the price development of the real Facebook and IBM shares 100%. This is the beauty of Spread Trading. Whatever you are trading is a 100% reflection of the real underlying market.

For example, let us assume you are trading Bitcoin. Although you stand to make or lose money, depending on the direction of Bitcoin, you do not actually own any Bitcoins. You just speculate on the coin falling or rising. Your advantage is that you do not have to physically buy it to profit from it. You can just trade it through a Spread Trade contract.

On any given market the quoted price is a 1:1 reflection of the real market price of the underlying instrument. In other words, regardless of which instrument (shares, stock indices, currency pairs, commodities, cryptocurrencies etc.) the price of the Spread Trading contract moves in sync with the market in question.

When the underlying market is closed (for some markets during the night), most brokers today will quote you an artificial price to trade at (typically with a wider Bid-Ask spread).

Spread Trades are traded on margin

Spread Trading and Single Currency Spread Trading contracts are traded on margin. What that means is that you can speculate on the direction of financial market products using these contracts, without paying the full price.

The amount of margin you deposit with your broker will depend on which broker you use. Let us say for the sake of the example that the broker you use offers margin of 100 to 1.

What that means is that you will be required to deposit on your trading account an amount which is just 1% of the value of what you are trading. I will explain margin in more detail later in the book, when I show you practical examples of Spread Trading contracts.

Some brokers will offer you margin of 300 to 1. That means you only put down 1/3 % of the value of what you are trading. Some brokers will offer you margin of 200: 1. That means you only put down ½% of the value of what you are trading.

You can “go short” a Spread Trade Contract

Now, this may be new to you. Even though it is easy to understand for a professional trader, it sometimes causes confusion for the newcomer. You can “go short” a Spread Trade contract. Going “short” means you are selling something now, and hoping to buy it back later, at a cheaper price.

Think of it like this. You are selling something at €10, and you receive €10 in your pocket. Now you have an obligation to deliver the “something” at some point in time.

Imagine you are able to buy it back a short time later and you buy it back at 9. You received 10 for it, and you paid 9 for it. That is the essence of shorting. I will discuss shorting later in the guide.

You generally do not pay commission when you Spread Trade.

You generally do not pay commission when you spread trade. The brokers I use, and that I will recommend you trade with, do not charge commission when you trade.

You can pretty much trade anything on a Spread Trading Contract.

You can trade individual shares like Facebook and Google, stock indices like the Dow Jones index, currency pairs from the entire globe, commodities like Gold and Oil. It means that you can create a trading plan in any trading instrument that suits you.

What you need to know is that Spread Trading brokers often are not allowed to use the real names of the product they are trading because of copy right protection. Therefore, they call them something else. Here are four examples:

Real Name Name Brokers use

Dow Jones Index US 30 – USA 30 – Wall Street 30

DAX Index Germany 30

Nasdaq Index US Tech 100

FTSE 100 Index UK 100

The real name of the German share index is called the DAX index. However, as shown above, spread brokers will have to call it something else to get around the copy right protection. However, and this is an important point, the prices of the indices you see on the platform is a 100% true reflection of the real index market.

You do not own what you trade.

This is an especially important point to remember – when you trade a Spread Trading Contract, you are not trading the “real” thing.

If you are trading say Facebook shares on a Spread Trading Contract, you are not actually an owner of Facebook shares. However, you are trading a product which mirrors the real Facebook shares.

So, if the real Facebook shares increase by 1%, so too will the Facebook Spread Trade Contract share. A Spread Trade is created to enable you to speculate on the direction of global financial instruments without actually owning them. This is a huge advantage for traders and speculators. They can speculate on the direction of thousands of instruments without ever taking real ownership of them.

Next Chapter

In the next chapter I will teach you about trade size.

Trading Size on Spread Trades

When you are trading Spread Trading & Single Currency Spread Trading contracts, you decide how much you want to risk per point movement. This is an advantage a Spread trader has over traditional traders.

Those who trade futures contracts must trade “contracts”. The size of the contract is determined by the exchanges where the product is traded.

For example, one of the most popular contracts in the world is the SP500 e-mini contract, which is traded on the Chicago Mercantile Exchange, also known as the CME.

When you trade 1 contract of the SP500 e-mini, you risk $50 per full point movement in the SP500 index.

What is so clever about Spread Trading is that YOU decide what your stake size is, not the broker or the exchange. You can trade as little size as you want or as big size as you want. You can trade an uneven size, or with a decimal point, if you want. It is 100% up to you.

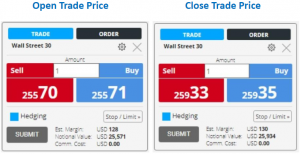

What is meant by “per point movement”? let me give you an example of what is meant by points, this time in the Dow Jones index, which is actually called “Wall Street 30”.

On the trading ticket to the left, the price is 25,570 – 71. On the trading ticket to the right, the price is 25,933-35.

If you had bought “Wall Street 30” at 25,571, and you had sold it again at 25,933, you would have made 362 points. The reason being is that 25,933 – 25,571 = 362 points.

How much profit would you have made on this trade?

That would depend on the value of the “Amount”. If you put in “1”, then you would have made $362. It is that straight forward. Soon I will teach you about Single Currency Spread Trading. That will make Spread trading even easier to understand and trade.

What was your risk on this trade? That is where a stop-loss comes in. The stop-loss is not something you have to use, but I URGE you to use it.

Let us say you placed a stop-loss 100 points away from your entry price at 25,571. You would then have placed an order with the broker to close your trade if the Dow index reached 25,471.

You would have lost 100 points. If you had risked 1 dollar per point, you would have lost 100 dollars. If you had risked 100 dollars per point, you would have lost 10,000 dollars.

If you had risked 100 dollars and you had not been stopped out, your profit would have been 362 points * 100 dollars = 36,200 dollars.

SAME PRINCIPLE ON ALL SPREAD TRADING PRODUCTS

It does not matter what you trade. The principle is the same. Let us go through some more examples. The next example is for a currency trade. Many people trade with micro-lots and mini-lots. Spread Trading is much easier.

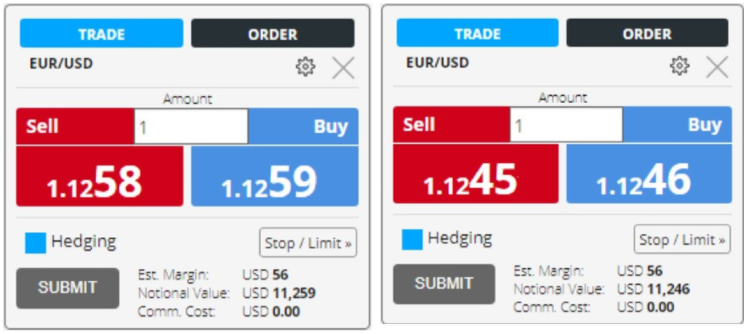

The most traded currency pair in the world is the Euro Dollar. This is the currency in the European Union vs. the currency in America. 30% of all Forex volume is traded in Euro Dollar.

On the trading ticket below to the left, the Euro Dollar exchange rate is traded at 1.1258–59. On the right-hand side, 30 minutes later, Euro Dollar is traded at 1.1245–46.

Imagine you had bought Euro Dollar at 1.1259, and the market then unfortunately declined to 1.1245-46. If you decided to close the trade, you would have to close it by selling it at 1.1245. Your loss would be 1.1259 minus 1.1245 = 14 points.

Imagine you had shorted Euro Dollar, at 1.1258 and you bought it back at 1.1246. You would have made 12 points.

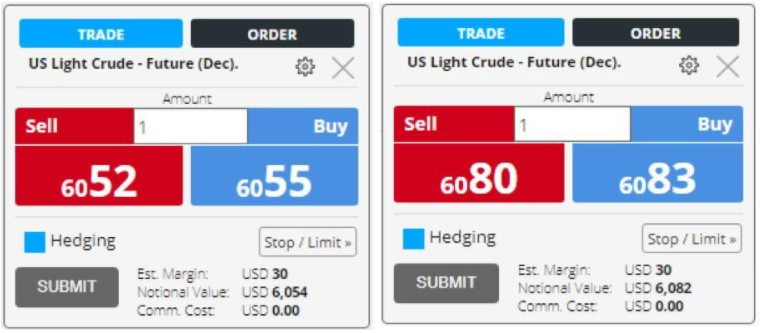

Example: Crude Oil

US Crude Oil is trading at 60.52-55. You decide to buy Crude oil at 60.55. Later you see that Crude Oil is trading at 60.80-83. You decide to sell at 60.80. How many points have you made?

You made 25 points (60.80 minus 60.55).

Next, I will discuss the value of a point. How much are you risking per point movement? I will also show you the difference between Spread Trading and Single Currency Spread Trading. I think you will appreciate that Single Currency Spread Trading is much easier to understand than traditional spread trading.

I should warn you that there are almost no brokers in the world that offer the simple form of spread trading called Single Currency Spread Trading. I will discuss this in greater detail in the next chapter.

Stake Size in Spread Trade Contracts

Up until now I have described the basics of Spread Trading. What I haven’t told you is a little more complicated. We are now going to cover this area, and then I will explain the alternative, which is called Single Currency Spread Trading.

When you Spread Trade, you nominate your “Amount” that you want to risk per point movement. What I haven’t told you is that the “Amount” will vary in currency denomination, depending on what instrument you are trading.

The amount you risk per point will be nominated in different currencies, depending on what product you trade. Let me give you some examples, which will make it easier to understand.

When you trade say Crude Oil, or Dow Jones Index, you are actually trading products that are nominated in US Dollars. This means that whatever stake size you input in your “Amount” is a US Dollar amount. If you input 10 in the amount area, you are risking 10 dollars per point.

The same goes with other products. If, for example, you are trading the German DAX index, you will be trading in Euros. The number you input in your “Amount” area is actually a Euro amount. So if you input 10, you are risking 10 euros per point.

Say you are trading the UK FTSE index, and you input 10 into the trading ticket, it means you are now risking 10 pounds per point. Say you are trading a currency pair like the Japanese Yen against the US Dollar, whatever amount you input in the stake size area will actually be nominated in Yen. You are trading Yen per points.

This is not always easy to get your head around, especially if you are trading say the Dollar Yen currency pair. You may be unsure how much you are actually risking per point movement in the currency pair, because you are not used to dealing in Japanese Yen.

BROKERS EXPLOIT THIS

When you trade traditional Spread Trades, as described above, your profits or your losses will now be converted back to your “base” account currency. Let me explain what is meant by that.

The “base” currency of your account is essentially your own national currency. I am from Denmark, so my Spread Trading account is based in Danish Kroners. It doesn’t matter where you live. You can decide your base currency to be whatever you want it to be.

When we trade a product like the Dow Jones index, we will essentially be making a trade in US Dollars. When the trade is closed, the broker will then “sweep” our profit or our loss back to our “base” currency. Sadly, many brokers use a really unfair exchange rate to do that.

There is an alternative, and it makes Spread Trading really straight forward, much easier than what was described above. It is called Single Currency Spread Trading.

Single Currency Spread Trading

The only difference between a normal Spread Trading account and a Single Currency Spread Trading account is the “stake size” in the “Amount” section of the trading ticket.

No matter what you trade, you ALWAYS nominate your stake size in your “base account currency”. It doesn’t matter if you trade Dollar Yen, or Crude Oil, or FTSE 100, or the DAX, or the Dow index, you ALWAYS trade your “Amount” size as your own local currency.

There are 3 advantages to Single Currency Spread Trading:

You always know the true value of your trade risk per point.

Profits or losses are applied immediately without using unfair exchange rates.

You can trade “exotic” products without being fearful of your risk size.

Remember that you are always trading for “points”, and you want to make as many points as possible in trading. Single Currency Spread Trading is no different in that respect, but the Single Currency Spread Trades allows you to nominate your stake size in your “local” currency.

For example, say you live in Europe and your base account currency is set in Euros, and you like to trade the Dow Jones index. Normally you would place the stake size in US Dollars per point. Then after the trade was closed, your profit or loss was converted back into Euros.

Now, instead of placing the stake size in US Dollars per point, you now place your stake size in Euros per point. What are the advantages of that?

It is much easier to understand your risk, when you know your risk per point in your local currency rather than a foreign currency. You don’t have to sit and wonder how much a dollar is in Euros, and then place your trade.

By trading in your local currency, you will never find yourself in a situation where you have risked too much or too little, because you were trading a product in a currency that you were not familiar with.

All brokers tend to charge you a little percentage fee for converting your profit or loss back to your “base” account currency. With Single Currency Spread account you never have to worry about that.

Let me give you a quick example of why Single Currency Spread Trading is so much smarter and so much easier to use than normal Spread Contracts.

Single Currency Spread Trading Example

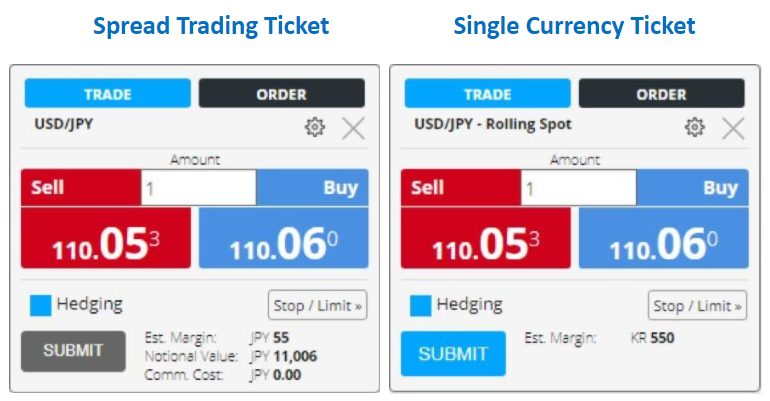

Below is a picture of a two almost identical Spread Trading contract tickets for Dollar Yen.

Left ticket = Normal Spread Trading Contract ticket

Right ticket = Single Currency Spread Trading ticket – in Danish Kroner

Spread Trading Ticket Single Currency Ticket

As I am Danish, I know exactly how much I want to risk in Danish Kroner. Say I want to buy Dollar Yen at 110.06 with a 20-point stop loss. I know exactly the value of my risk.

If I want to place the same trade using a traditional Spread Trading account, I now have to figure out how much I want to risk in YEN. This means I have to look up the exchange rate between Japan and Denmark. Once I have that exchange rate, I can now figure out what trade size to input in “Amount”.

Do you see how much more complex that situation is? When I make a trade, I know how many points I want to risk. As I am trading in my own currency, I immediately know what my total risk is.

Do you see how convoluted this process is, when in fact there is a much easier solution readily available? I simply select to trade Dollar Yen using a “Danish Kroner stake size. I know exactly how much each point is worth, and whether I trade a normal Spread account or a Single Currency Spread account, the point movement in Dollar Yen is the same. I never have to worry about the broker charging me fees for converting my profit or loss in Yen back to Danish Kroners.

Whoever you are, and wherever you are, you can have an account in whatever base currency you prefer. I like trading in Danish Kroners, because it is a currency that I am used to. You can select whatever base currency that you prefer.

Let us go through a practical example to illustrate how easy it is to trade using Single Currency Trading Contracts.

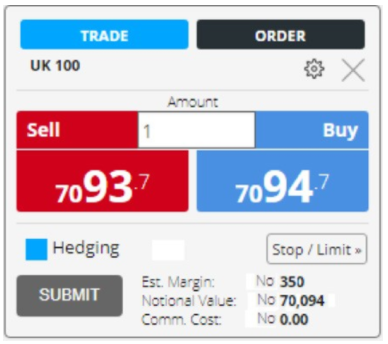

I have a friend in Norway called Steinar. He is a hobby trader, and a very good one. He likes to trade the English FTSE 100 index. Now the FTSE 100 index (called UK 100 because of copyright protection) is trading at 7093-94. Instead of buying the FTSE 100 at 7094 using a British Pound stake size, he simply uses Norwegian Kroner.

So, in the “Amount” on his platform, the number he writes is his exposure per point in Norwegian Kroner. Steinar never has to worry about making too big or too small trades, because he perhaps is not sure how much a US Dollar or a Euro or a Pound is worth in Norwegian Kroner. He knows how much he wants to risk in his own local currency.

Single Currency Spread Trading is just like Spread Trading – in every respect – except for the fact that you are always trading with stakes in your own currency. So, for my Danish trader friends, they trade using Danish Kroners as their stake size. My Norwegian friends trade in Norwegian Kroners. My friends in Europe trade in Euros, and my friends in the UK trade in Sterling Pound.

The prices move the same way, the margin is the same, all the products are the same. The only thing that is different is that your stake size per point is now always the same currency.

It is a much smarter way of trading because you always know the value of your “local” currency.

What is Margin?

Trading on margin means that you are able to trade without paying the full price for whatever you are trading. Margin enables you to take a position in a trading instrument by only depositing a small amount of money.

The comparison to a house purchase is not far off. You buy a house for €100,000 but you only deposit €10,000 with your bank. The rest, the €90,000, is lent to you by the bank.

Trading on margin means that only a fraction of the value of the full-sized underlying instrument needs to be present in your account.

There are 2 kinds of margins:

Initial Margin.

Variation Margin.

Initial Margin

Margin is not overly complicated to explain or understand, but you do need to take it seriously. The margin dictates how much you can trade on your account, so it is important you learn the implications of trading on margin.

Let us use the DAX index in this example. Imagine you input 1 in the “Amount” value on the DAX Index trading ticket. It means you stand to make or lose 1 euro for every point the Dax Index moves up or down.

Brokers offer different kinds of margin, so I will use a fairly standard margin rate, which is 100:1. It means that you have to deposit 1% of the value of your trade (1/100 = 1%).

Margin Calculation on 1%

Imagine the price of the DAX Index you are trading at is 11,000, then what does that mean?

Value of trade: 11,000 * €1 = €11,000

Margin = 100:1 1% of €11,000 = 110 euros

So, you need to have on your trading account at least €110 to cover the margin on this trade. That was pretty easy, wasn’t it? That €110 is what is called the Initial Margin.

What if you were trading €10 per point in the DAX?

Value of trade: 11,000 * €10 = €110,000

1% of €110,000 = €1,100

If I trade €10 per point in the DAX index, then I need to have at least €1,100 on my trading account. Again, the €1,100 is the Initial Margin.

Variation Margin

Variation Margin is different to the Initial Margin. The best way to describe variation margin to is say that whatever you are losing on your open trade needs to be covered on your account. In other words, your open loss on a trade needs to be 100% covered on your trading account.

Example of Variation Margin

You have €1,000 on your account.

You open a trade.

The Initial Margin is €100.

Now you only have €900 “free capital” on your account. The €100 is frozen. It is still on your account, of course, but you cannot use it for trading.

Now your open position is moving against you. Let us imagine you lose €50 on your open position. Now your account will look at follows:

Account: €1000 Initial

Initial Margin: €100

Variation Margin: €50

Free Account Capital: €850

You always need to make sure that your account does not go so low on funds that you are issued a margin call. A margin call is basically a call for you to deposit more funds on your account, because your open loss on your position exceeds the free capital on your account.

One great feature for new Spread Traders is that you can trade very small sizes. You will find that most brokers will give you the ability to trade in increments below €1 (or whatever your local currency is).

This means that you can even trade in contract values like 0.1 or 0.5 in order to further reduce the risk of the trade. This is a really great feature when you are learning to trade. It also means you can start trading with a very small account size.

Your understanding of Single Currency Spread Trading is nearly complete. The next chapter will teach you about stop-losses and limit orders. After that I will teach you about shorting the market.

Stop-Loss Orders and Limit Orders

Any trader who has been in the game for a while will tell you that you need to learn to protect your money. One friend says it very poetically: “Take care of your losing trades, because the winning trades take care of themselves.”

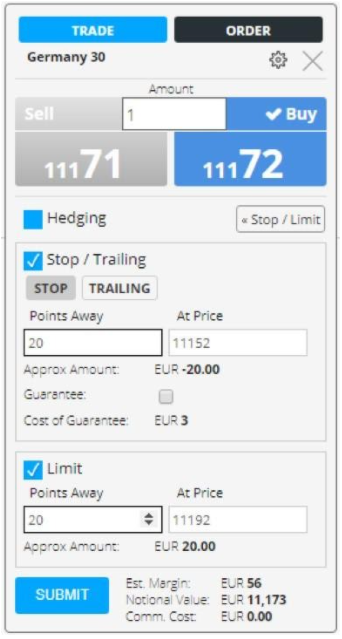

We have tools to help us protect our money. It is called a stop-loss, and it is really simple to use. Look at the trading ticket below. It shows you the DAX Index right now, but the trading ticket will look different to what I have shown you previously.

What is a Stop-loss order?

A stop-loss is an exit order for when the market moves against you. For a long trade – when you buy the market – it gives you protection if the market moves lower.

If you have sold short the market, a stop-loss will protect you if the market moves higher. It is an efficient way of protecting yourself against out-of-control losses on your trading account. Losing trades is inevitable. No one wins all the time. The trick is to keep the losses small, and the profits bigger than the losses.

On the trading ticket above, you see two types of orders. There is a Stop order and there is a Limit order.

In this situation, where I am looking to BUY the DAX, the stop order will close my position, if the market moves against me by an amount of points that I decide. I do not have to use a Stop order, nor do I have to use a Limit Order. It is 100% up to me.

I always place a stop loss based on one of the two following criteria:

I don’t want to lose any more money on this trade.

If the market moves against me by a set amount of points.

Placing a stop loss will take some practice. You do not want the stop loss to be too close. Otherwise you will probably get stopped out even though the market may well move in your favour later.

However, you do not want to place it too far away either. As I said, it will take some practice to get your stop loss right.

Let us take a look at the trading ticket below. There you see how you can input your stop loss and your limit order. A stop-loss order is an order to exit the market – if the market moves against you. A limit order on the other hand is an order to exit the market – at a point where your position is in profit.

Let’s take a practical example based on the trading ticket just shown.

Stop Order

The DAX Index (called Germany 30 here) is trading at 11,171-72. If you decide to buy the DAX at 11,172, and you want to risk 20 points, then your stop-loss will be at 11,152.

So, the trading platform creates an “exit order” for you at 11,152. If the market moves down to 11,152, your position will be closed, and you will lose 20 points.

Limit Order

A Limit Order works differently. The limit order creates an exit, when you are in profit.

If you buy the DAX Index at 11,172 and the market moves in your favour, in this example you want to exit with 20 points of profit.

If the DAX moves up to 11,192, the trading platform will exit your position with 20 points of profit. You don’t even have to be there to make sure it happens. It happens automatically.

IMPORTANT MESSAGE

I didn’t write this book to give you trading advice, but to guide you through the world of Spread Trading. However, I will make an exception here. I don’t want you to ever place a trade without a stop-loss. You don’t have to use a limit order. You can and should let your profits run, but PLEASE do not trade without a stop-loss.

Next Chapter

The next chapter is called “Shorting”, and this chapter you will learn how you can make money from falling markets. Being able to short the market means you can take advantage of falling prices.

Shorting

There are many famous stories about people making fortunes by selling short a market. For example, George Soros, the famous Hungarian speculator, reportedly made $1 billion in 1992 by selling short the British Pound.

There is a famous movie made about people selling short the American housing market in 2007. It is called The Big Short. If you haven’t seen it, you should. It is both entertaining and educating.

When someone wants to buy something in the market, you will need someone to sell it to you. Does it matter to you if that person on the other side of the trade is selling something that he or she had bought at some point in the past, or that he or she has a different opinion to you, and they think the market is headed lower.

If you transact in the market place and trade at a fair price, does it worry you so much that someone has a different opinion to you? It doesn’t bother me, and it doesn’t bother me that someone is shorting say a stock that I am buying. May the best man/woman win!

I personally don’t think that there is anything immoral by selling short, but some people do. I respect that people will have their opinions, so I will instead focus on the mechanics of selling short here.

What we are doing when we SELL SHORT, is to sell first and buy back later. In theory, the risk is infinite on a short trade as “the sky is the limit” upwards, whereas the risk on a long trade is always limited at zero. In the real world, however, a short trade does not entail any more risk than a long trade, as the combination of stop-losses and margin calls would get us out sooner or later anyway.

Market Reality

As an investor you are looking at the market from one perspective, and one perspective only. You want to invest in something, and then you want the value of your investment to go up. The way you increase your wealth is if the market continues to buy your investment.

As a trader and a speculator, you have more than one perspective. You can buy the market – in the hope that it moves higher – or you can sell short the market – in the hope that it moves lower. The basic premise of a short trade is simple. You decide that you think the market in question is about to move lower. By selling short you want to take advantage of falling prices. Your risk is that the markets will rise.

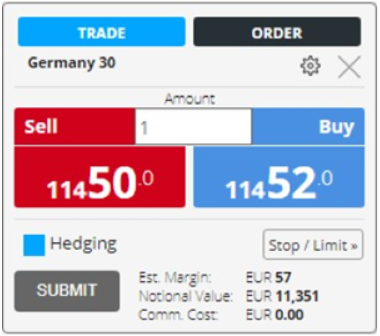

Whenever we are looking at a trading ticket, we will have two prices to deal on. You can BUY the higher price or SELL SHORT the lower price. That is just the facts of the financial markets. As someone who has made more than a fair return on “shorting”, I can only recommend taking this possibility very seriously.

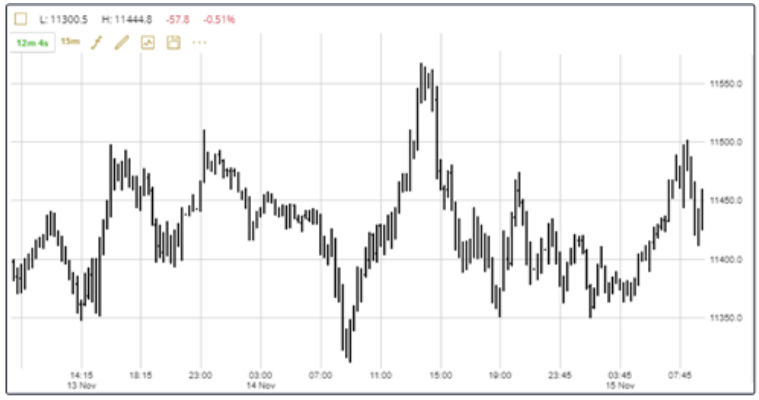

Let’s go through a practical example of shorting and how I may come to the conclusion that I want to sell short something. On the chart below, you see the German DAX index over 2-3 days. I am a trader who uses charts to decide whether I want to be LONG the market, or if I want to be SHORT the market. When I looked at this chart, I decided I wanted to be short the market.

The trading ticket told me I could sell short the DAX at 11,450. I input my stake size (not shown below), and I put in my stop loss, and then I pressed “Sell”. That was it. I was now short the DAX index.

So, you can see that shorting isn’t much different to buying. You have an opinion, and you press the button. If the market agrees with you, you make money. If it doesn’t, well then you lose money.

The market doesn’t care if you are short or long. The market doesn’t have an opinion. The market is just a place where people like you and I meet up to conduct our business.

Regulations

As you can see from what you have learned so far, being able to trade on margin enables you to take on a bigger risk with a smaller amount of funds.

If margin is 10:1 then you need to deposit 10% of the value of your trade, but if margin is 100:1, then you only need to deposit 1% in margin. You can obviously take on more risk with a 100:1 than a 10:1 margin requirement.

Is that a good thing?

Well, for someone like me, who knows what I am doing, it is a good thing. However, when you are learning to trade, you need to start slowly and build up your expertise.

There are big differences in the margin made available to clients. For example, if you open an account with a European broker, then you are subject to much more restrictive margins than if you open an account with a broker outside Europe.

As of August 2018, ESMA, the European Securities and Markets Authority, have tightened its restrictions on trading accounts. This means that the amount of margin on various products has been severely restricted, compared to what it was before.

For example, the most leverage that a client now can get in Europe is 30:1. It is not all bad, because ESMA has also created by law a rule that states that clients can’t lose more than is available on their trading account. Negative balance protection, as it is called, means that a client can’t end up owing the brokerage money.

These rules do not apply to clients that obtain professional status and, moreover, brokers outside the EU are not bound by these regulations. For instance, it is possible to open an account with a host of companies outside the European Union. I have written about these changes extensively on my website www.tradertom.com. In particular you should consider reading the following two articles:

https://tradertom.com/are-brokers-creating-a-dangerous-situation-with-the-new- pro-status/

Learning to Trade

I have written an extensive trading course, which I am giving away for free. It is a 180-page book you can download free of charge. I argue it is better than some of those £3000 courses you see advertised.

I hope you will take the time to download it and send me your feedback.

You can find it free of charge on my website here: https:// tradertom.com

Content

- The 24-HourTrading Cycle

- Basic Technical Analysis Price Action & Price Behaviour

- Principles of Price Action & Trend

- Trend Indicators

- Daily Work Routine

- Candlestick Charting

- The Essential 8 Candle Patterns

- Understanding Chart Time Frames

- Trade Entry Technique 4 Bar Fractal

- Divergence Strategies

- Managing Your Risk

- Forex Markets & Forex Trading

- Basics Facts of the Forex Market

- Practical Forex Trading Terminology

- Quick Guide to Spread Betting / Trading

- What Makes Markets Move?

- Case Stories & New Entry Techniques

- Trading Psychology

Closing Comment

I want to say thank you for downloading my 30 Minute Guide to Spread Trading & Single Currency Spread Trading.

I hope I have lived up to my promise: to teach you all there is to know about Spread Trading in just 30 minutes. If it took a little longer than 30 minutes, I hope you found it to be worth the extra minutes you spent.

I love trading, but as I get older and hopefully a little wiser, I have come to like teaching other people how to trade as well. When you trade, and you made a good return, it feels great. When you teach, and you have an interested student, who then goes on to do well in trading, it feels great too, but it is a more lasting sensation. It feels as if you have made a difference in someone’s life.

I hope our paths cross one day. Until then, I wish you a great journey.

Kindest regards

Tom Hougaard